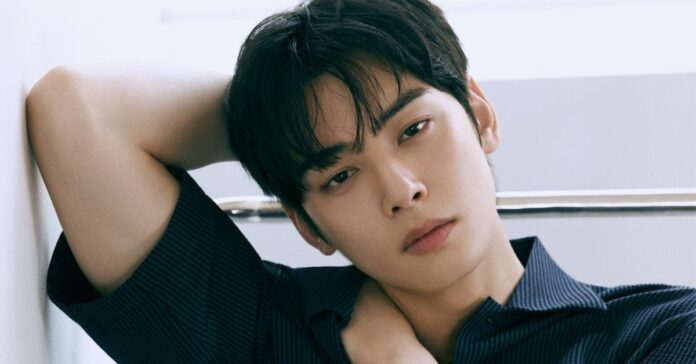

South Korean actor and idol Cha Eun Woo’s agency, Fantagio, has addressed recent allegations linking the ASTRO member to possible tax evasion.

According to Soompi, a media outlet reported on January 22 that Cha Eun Woo was investigated last year by Investigation Bureau 4 of the Seoul Regional Tax Office on suspicion of tax evasion. The report alleged that the National Tax Service (NTS) imposed an additional tax assessment exceeding 20 billion won (around $13.6 million) in income and related taxes.

The report claimed that the NTS took issue with the structure of the artist’s income. Despite being signed to an agency, Cha Eun Woo was alleged to have used a separate family-run company, established by his mother and referred to as Corporation A, to split income among Fantagio, the corporation, and himself.

Authorities reportedly concluded that Corporation A did not provide substantive services and classified it as a “paper company,” leading to the assessment of unpaid taxes.

In response, Fantagio released an official statement, saying, “The key issue in this matter is whether the corporation established by Cha Eun Woo’s mother falls under the category of an entity subject to substantive taxation. Nothing has been finally confirmed or officially notified at this time, and we plan to actively clarify the matter in accordance with lawful procedures.”

The agency added, “In order for the process to be concluded as swiftly as possible, the artist and his tax representative will cooperate diligently. We assure you that Cha Eun Woo will continue, as a citizen of this country, to faithfully fulfill tax filings and his legal obligations.”

Cha Eun Woo is currently serving his mandatory military service as part of the Army Military Band, having enlisted in July last year. He is scheduled to be discharged on January 27, 2027.